COS - S/S 2021

Product Range Planning & Sales Forecast

The use of hierarchy for the product development strategy is fundamentally to assemble product ranges that allow fashion buyer, merchandiser and developer to provide the balance product mix including material, style and colours. Furthermore, it would suggest the prices to enable the range to fill the consumer demands. Therefore, it is suggested to use a structural hierarchy framework to analyse and classify the essential products, also their exclusivity based on the price range since it can be helpful to identify it briefly (Clark 2015).

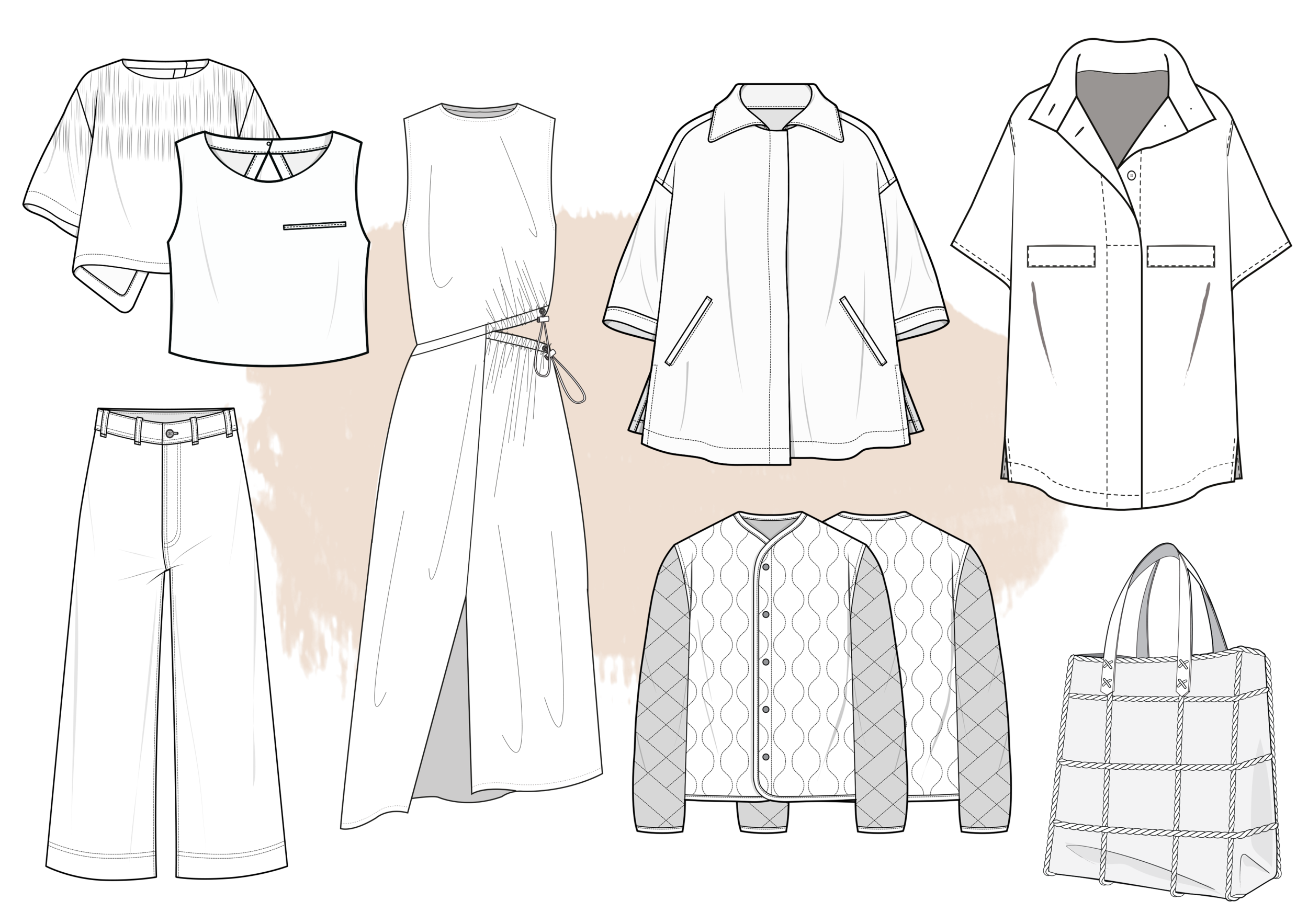

Figure 1: Product Hierarchy for the COS Womenswear and Menswear

The exclusivity of the COS products can be found through the use of materials as well as the price ranges. The figure depicts the COS key apparel products and divided into three levels which cover limited products, seasonal and or classic items. The top part shows the variety of exclusive items which are the most expensive within a minimal amount and usually have a distinctive style to highlight the collection, also specify for the target consumer. The middle part is where all the seasonal items, which usually feature trendy design and style. The last is the bottom part includes all the primary product that is available in all seasons and the most affordable as it is an essential fashion item for everyone and target the largest group of consumers.

COS Product Range Planning – Spring/Summer 2021

According to Goworek (2014), as the part of early stage of critical path in the fashion business, the range planning and selection is crucial to be carefully executed as it involves collecting acceptable collection of garments in the market within design and financial parameter, prior to production and retail delivery. The two essential sources of reference for planning the product range are the retailers sales report and the forecasted fashion trend for the brand. Since the COS does not publicly publish their financial and annual report, it is suggested to focus on the bestselling pieces as a start for range planning.

Reviewing the previous trend forecast for the upcoming Spring/Summer 2021 with big themed trend guides by Ross (2019) from WGSN, the highlight of key products development within the silhouette, fabric, colour and style of the design in this range planning as follows:

Womenswear S/S 21

Minimal boxy silhouette and quilted outerwear for womenswear (Bowring 2019).

Menswear S/S 21

Knitted polo T-shirt & shirt, minimal boxy outerwear in cotton denim and fine gauge stripe cardigan for men as the core items (Barnes 2019).

Based on the online and offline observation, the new arrival items from the current collection of the COS for Women and Men are 99 and 69 designs respectively. This observation outcome shows the amount of style they design for a new collection which help the design developer to plan the product range for the next seasons.

Figure 4: COS store in Spitalfields London features the new arrival collection in February

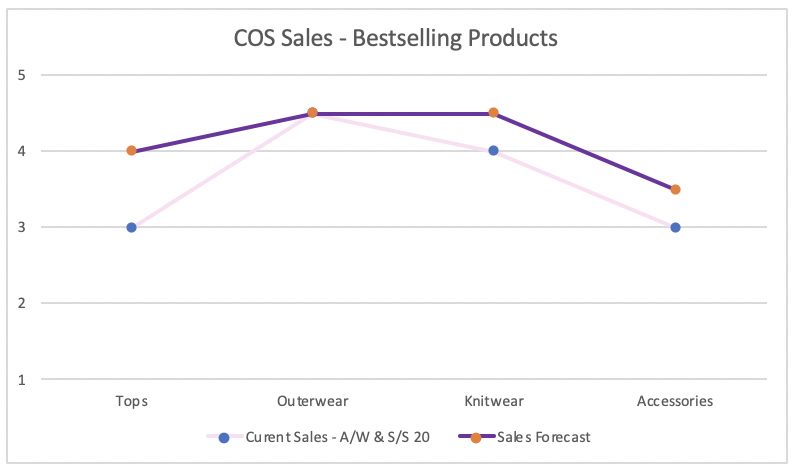

Sales forecasting – COS Spring/Summer 2021

The price ranges for the COS bestseller items stated in the official online website.

The graph predicts the prospective sales for conventional bestselling products of COS in the United Kingdom. The ultimate financial forecast for Spring Summer 2021 is that the resourcing and production cost shall remain steady in product development within the foreseen of increasing sales in specific bestseller product categories. However, it predicts the outerwear sales to continue the same and shall not fall since people are assumed to be less likely to purchase it in the Summer. In the sense that even if the materials new product ranges are expected to be newly innovative, yet it should not be more costly than the average buying budget in the company, and this brief analysis could potentially develop with the actual sales data.